- Doctor of Philosophy

- Master of Arts (by research)

- Master of Science (by research)

- Candidates enrolled in the following full-time subsidised coursework programmes:

- Master of Arts (Applied Linguistics)

- Master of Arts (all specialisations)

- Master of Science (Exercise & Sports Studies)

- Master of Science (Life Sciences)

Not Eligible for Tuition Fee Loan:

- Students receiving Government / Statutory Board / NIE scholarships which cover tuition fees

- International students paying non-subsidised tuition fees

- Students receiving full Tertiary Tuition Fee Subsidy from Mendaki

- Students using CPF savings for the full payment of the subsidised tuition fee

- Students in self-funded programmes

- Part-time graduate students (coursework)

- BA/BSc (Education) student teachers who receive salary, stipend and whose fees are not paid by MOE

- Full-fee paying students

- Part-time student teachers

All students:

Not Eligible for Tuition Fee Loan:

- Students receiving any Government / Statutory Board / NUS Scholarships which cover tuition fees

- Students receiving full tuition fee subsidy by MENDAKI

- Students using Central Provident Fund (CPF) savings for the full 100% payment of the subsidised tuition fees

- Students on self-funded graduate programmes

- International students paying full fees; not taking tuition grant

Guarantor requirements 4 :

- 21 - 60 years old

- Must not be bankrupt

NOTE: You must have a guarantor with you to apply for the Tuition Fee Loan.

Nationality requirements:

- If student is a Singaporean, guarantor must be Singaporean

- If student is a Singapore PR, guarantor must be Singaporean / Singapore PR

- If student is a Foreigner, guarantor can be of any nationality

3 For selected NTU part-time and postgraduate courses.

HOW TO APPLY

4 Guarantor must not be an undischarged bankrupt.TFL Application Form

Submit your TFL Application Form with your guarantor at any OCBC Branch

Click the link below > Download > Save to your desktop > Open with PDF Reader

Branch opening hours

Submit your TFL form to any OCBC Branch with your guarantor.

Submission of TFL form and documents are available at the campus FRANK Stores on the following days from 17 June to 30 September 2024.

- NUS - Mon to Fri (11am to 2pm)

- NTU - Mon to Fri (9am to 2pm)

- SMU - Mon, Tue, Fri (11am to 2pm)

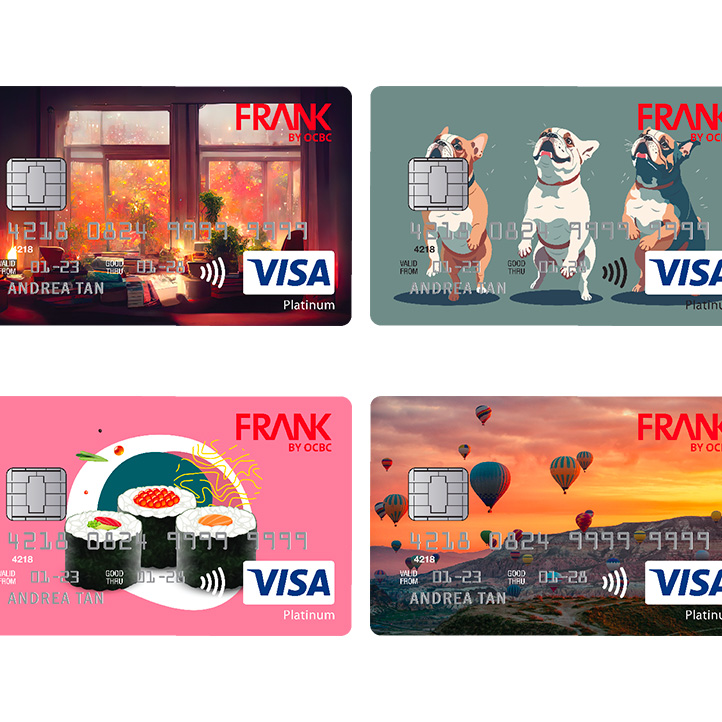

Tuition Fee Loan + FRANK Visa Debit Card Benefits

Enjoy perks while you push ahead in your studies. Choose from over 60 designs. Annual FRANK Debit Card fee waiver for life. Withdraw cash locally and overseas.

INTEREST RATE CHANGE LEARN MORE ABOUT THE NEW MOE INTEREST RATEs

Starting from 1 April 2024, all new applications for MOE-funded loans will be subject to the revised interest rates. The rate adjustments will occur on a half-yearly basis, effective every 1 April and 1 October.

Refer to our latest page to understand how the new interest rates may impact your loans.

Find out moreWhat do I need to prepare:

- NRIC

- School Letter of Admission / Student Matriculation card

- NRIC

- Passport (Identity Cards can be used for Malaysians)

- School Letter of Admission

- IPA print out or ICA pass (for sanctioned countries)

- Passport (Identity Cards can be used for Malaysians)

- For sanctioned countries

- Letter of Admission / Work Permit

- IPA Print out or ICA pass

Applicant:

Existing OCBC customer

- NRIC

- School Letter of Admission / Student Matriculation card

- Passport

- School Letter of Admission

- IPA print out or ICA pass (for sanctioned countries)

Guarantor:

Guarantor:

Singaporean / Singapore PR

- Passport (Identity Cards can be used for Malaysians)

- For sanctioned countries

- Letter of Admission / Work Permit

- IPA Print out or ICA pass

5 For selected NTU part-time and postgraduate courses.

6 Guarantor must not be an undischarged bankrupt.

Additional Details:1 Based on a Singapore citizen university student's tuition fee.

2 Interest commencement date is set by university. Loan interest is based on the average Prime Lending Rate of Oversea-Chinese Banking Corporation (OCBC), Development Bank of Singapore (DBS) and United Overseas Bank (UOB). Late interest of 1% per month on the outstanding amount will be charged if repayment is late.

3 Additional loan interest of 1% per month on the outstanding loan will be charged if you do not start repaying a minimum of S$100 monthly within 2 years from graduation.

4 This is the maximum period of making monthly repayment instalments from graduation day.

5 For selected NTU part-time and postgraduate courses.

6 Guarantor must not be an undischarged bankrupt.

Join other trail-blazing young adults in getting monthly career & financial tips, written by those who have succeeded before.